Financial Resilience

Financial Planning

Financial Wellbeing

Our Story

During the COVID-19 pandemic, many people, individuals and families lost their jobs. Many other died who were wage-earners or breadwinners for the family. Families with low income were hit hard. Affected families were unable to navigate this hard time with appropriate financial decisions for many reasons including lack of knowledge and preparation. It is in this backdrop, we decided to create an organization which would help the underserved low income families or middle income families to understand financial literacy in the first place, and then to apply their knowledge and understanding in planning for unpredictable financial events in their lives. This is the shortest story of the birth of this organization.

Mission

Purity wants to promote financial literacy and education among all American population, especially, its underprivileged segments and encourage financial planning which would create sustainable financial strength among them resulting in greater individual financial wellbeing, social harmony, and economic equity.

Vision

Purity hopes to enhance Americans’ integration into mainstream financial systems by promoting financial literacy, education, planning and research to facilitate sustainable economic well-being and equity.

Outcome

The expected outcome of this initiative include:

● Improved financial well-being and literacy.

● Enhanced Social harmony and economic equity.

● Lower extremism arising from inequity and poverty.

● Greater social and economic integration.

Our Purposes

The purposes of Purity Financial Education and Planning as set forth in the Articles of Incorporation, is charitable within the meaning of section 501(c)(3) of the Internal Revenue Code of 1986, as amended, or the corresponding provision of any future Federal tax law (“Section 501(c)(3)”). More specifically, the objectives and purposes of this organization shall include but not limited to the following:

1. To enhance Americans’ integration into mainstream financial systems,

2. To promote financial literacy, education, planning and research, and

3. To facilitate sustainable economic well-being and equity.

We expect to reach out to the underserved population in the US including immigrants who often form ethnic and religious minority communities. Members belonging to underserved communities are often not integrated with the mainstream financial system. This can be due to their lack of financial access or financial literacy which would have resulted in financial capability in the short run and financial wellbeing in the long run.

Our Programs

Informative Webinar & Invited Lecture

Educational Literature & Videos

Planning & Counseling

Research & Analysis

Sharing Financial Knowledge

Partnership & Collaboration

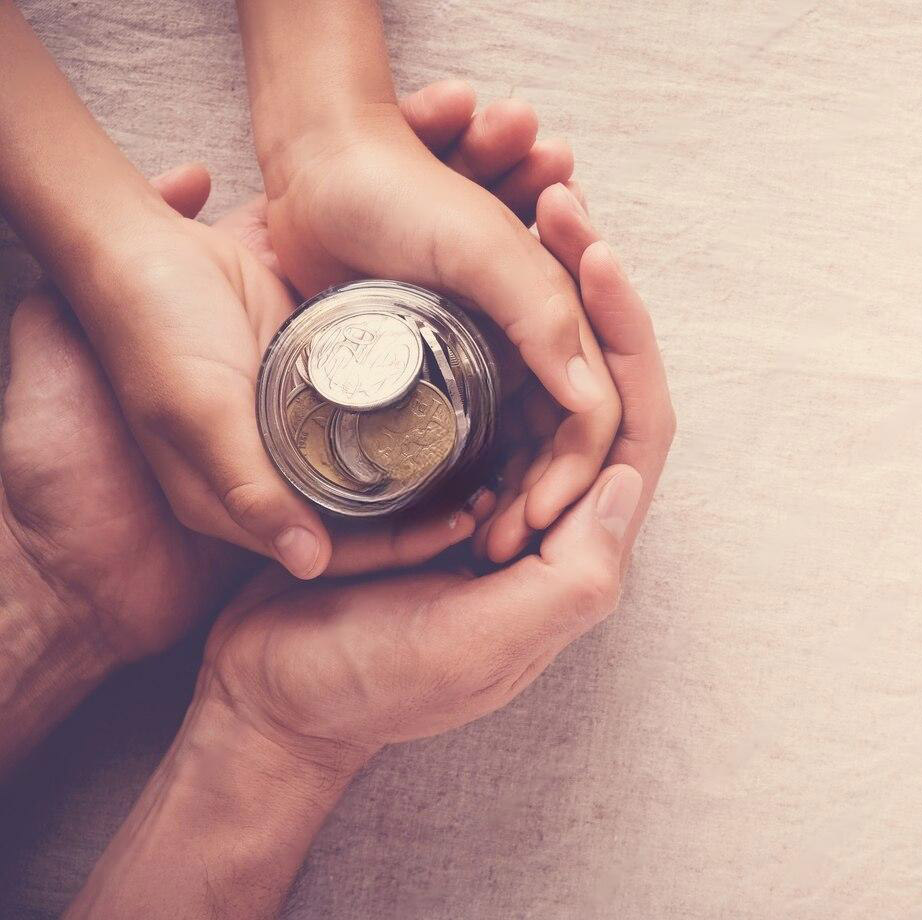

You can also participate in this noble effort!

Consider donating to strengthen our initiative and promote financial literacy and wellbeing among the financially underserved in the US!

Your donation is tax-deductible!